The Dangerous "Nvidia Made Record Q3, AI Bubble Fears Over" Narrative

I noticed a disturbing trend in the tech news cycle over the last 24 hours. Major outlets are running victory laps following Nvidia’s Q3 earnings report, pushing a specific and dangerous narrative: Nvidia beat expectations, therefore the fears of an AI bubble are officially over.

This is intellectually dishonest. It ignores the basic timeline of how enterprise hardware procurement works.

To look at a revenue beat from contracts signed six to twelve months ago and claim it invalidates concerns that only started gaining traction in the last eight weeks is absurd. The market is celebrating a lagging indicator. The billions in revenue Nvidia reported yesterday were locked in during the absolute peak of the 2024 hype cycle, when panic-buying was the standard operating procedure.

The "Sold Out" Mirage:

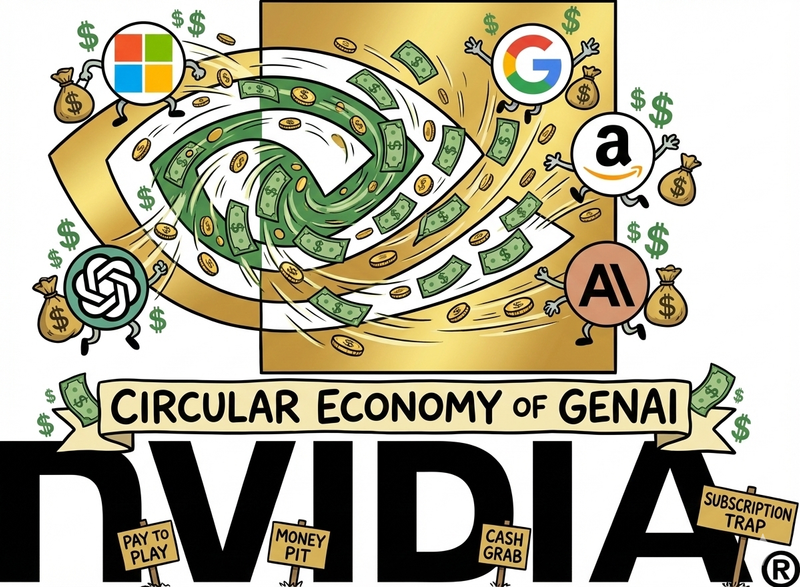

Nvidia and the press are making a great deal of noise about the Blackwell chips being "sold out" for the next year. Of course they are. These orders were backlogged and signed ages ago, fueled by the circular economy of Generative AI.

We know how this money moves. Hyperscalers invest billions into AI startups; those startups return that capital to the hyperscalers for cloud credits; the hyperscalers use that "revenue" to justify buying more Nvidia silicon. It is a closed loop. The fact that Nvidia is shipping against a backlog funded by this circular cash flow proves nothing about actual end-user demand or profitability today.

The Physical Reality Check:

While the media fixates on stock charts, the physical reality of the infrastructure build-out is hitting a wall that hype cannot bypass.

We literally have Microsoft CEO Satya Nadella admitting that silicon is no longer the primary bottleneck. He stated recently that the real issue is power and "shells" (data center buildings). He essentially admitted they have chips sitting in inventory that they cannot plug in because the energy infrastructure does not exist.

When the CEO of the primary customer for these chips says they have inventory they can't use, that is not a signal of infinite demand. It is a signal of saturation.

✅ The Verdict

The "AI Bubble" narrative is not dead. It is simply being ignored by people who are paid to keep the line going up. Scrutiny on the actual ROI of GenAI is rightfully increasing, and the needle is moving closer to the pop. Using financial results that were effectively predetermined a year ago to dismiss real-time economic and physical constraints is pathetic.